Senior Expertise and Professional Competence

Senior Expertise and Professional Competence

Senior Expertise and Professional Competence

Who We Are – Experience-based Strategy and Management Consultants for Financial Service Institutions

Who We Are – Experience-based Strategy and Management Consultants for Financial Service Institutions

BMC Professionals supports clients to solve strategic management challenges and implement the solutions. Our partners are experienced top management consultants with considerable expertise in the financial services industry.

We combine our competencies with those of specialized network partners. In this way, we configure lean, tailor-made consulting teams for the specific needs of our clients.

How We Work - Our Consulting Approach

Managing Strategic Challenges

Innovative Concepts and Implementation Support

Focused, Specialized Teams

Tailor-made Solutions for Our Clients

As strategy consultants, we work with our clients' management on their most important challenges. We are defined by our expertise and approach to dialogue, not by generic standard consulting.

We solve customer problems, but also provide implementation support. We are defined by getting results, not by colorful, high-gloss presentations.

We work exclusively in focused teams with specialized experts. We are defined by our know-how and experience, not junior consultant pyramids.

We know that every client and every customer problem is individual. We are defined by tailor-made solutions for our clients, not off-the-shelf, standard concepts.

How We Work - Our Consulting Approach

Managing Strategic Challenges

As strategy consultants, we work with our clients' management on their most important challenges. We are defined by our expertise and approach to dialogue, not by generic standard consulting.

Innovative Concepts and Implementation Support

We solve customer problems, but also provide implementation support. We are defined by getting results, not by colorful, high-gloss presentations.

Focused, Specialized Teams

We work exclusively in focused teams with specialized experts. We are defined by our know-how and experience, not junior consultant pyramids.

Tailor-made Solutions for Our Clients

We know that every client and every customer problem is individual. We are defined by tailor-made solutions for our clients, not off-the-shelf, standard concepts.

Our Competencies - Four Key Capabilities

Our Competencies - Four Key Capabilities

Market and Distribution Strategy, Digitization

- Strategic business development

- Strategic positioning

- Business model definition

- (Digital) customer and sales strategies

- Control and process optimization in multi-channel distribution

- Product development, innovation and management

Strategic Optimization of IT & Operations

- Optimization of IT project portfolios

- Project review, project rescue and quality assurance

- IT-Strategie und Architekturentwicklung

- Payment transactions, security settlement and credit processes

- Flexible, lean operating and sourcing models

Targeted Implementation of Regulatory Requirements

- Regulatory radar and impact assessment on business/operating model

- Regulatory project (portfolio) alignment and review

- Focus / review of individual projects

- Design of finance and risk architecture: functional, applications, data

- Program guidance and quality assurance

Organizational Optimization and Efficiency Management

- Service-oriented, effective organization

- Reorganization, post-merger integration

- Analysis of cost structures and complexity

- Levers and action plan for efficiency optimization

- Implementation support and benefit capture control

Market and Distribution Strategy, Digitization

- Strategic business development

- Strategic positioning

- Business model definition

- (Digital) customer and sales strategies

- Control and process optimization in multi-channel distribution

- Product development, innovation and management

Strategic Optimization of IT & Operations

- Optimierung des IT Projektportfolios

- Project review, project rescue and quality assurance

- IT Strategie und Architekturentwicklung

- Payment transactions, security settlement and credit processes

- Flexible, lean operating and sourcing models

Targeted Implementation of Regulatory Requirements

- Regulatorischer Radar

- Auswirkungen Regulierung auf Geschäfts-/Betriebsmodell

- Regulatory project (portfolio) alignment and review

- Focus / review of individual projects

- Design of finance and risk architecture: functional, applications, data

- Program guidance and quality assurance

Organizational Optimization and Efficiency Management

- Service-oriented, effective organization

- Reorganization, post-merger integration

- Analysis of cost structures and complexity

- Levers and action plan for efficiency optimization

- Implementation support and benefit capture control

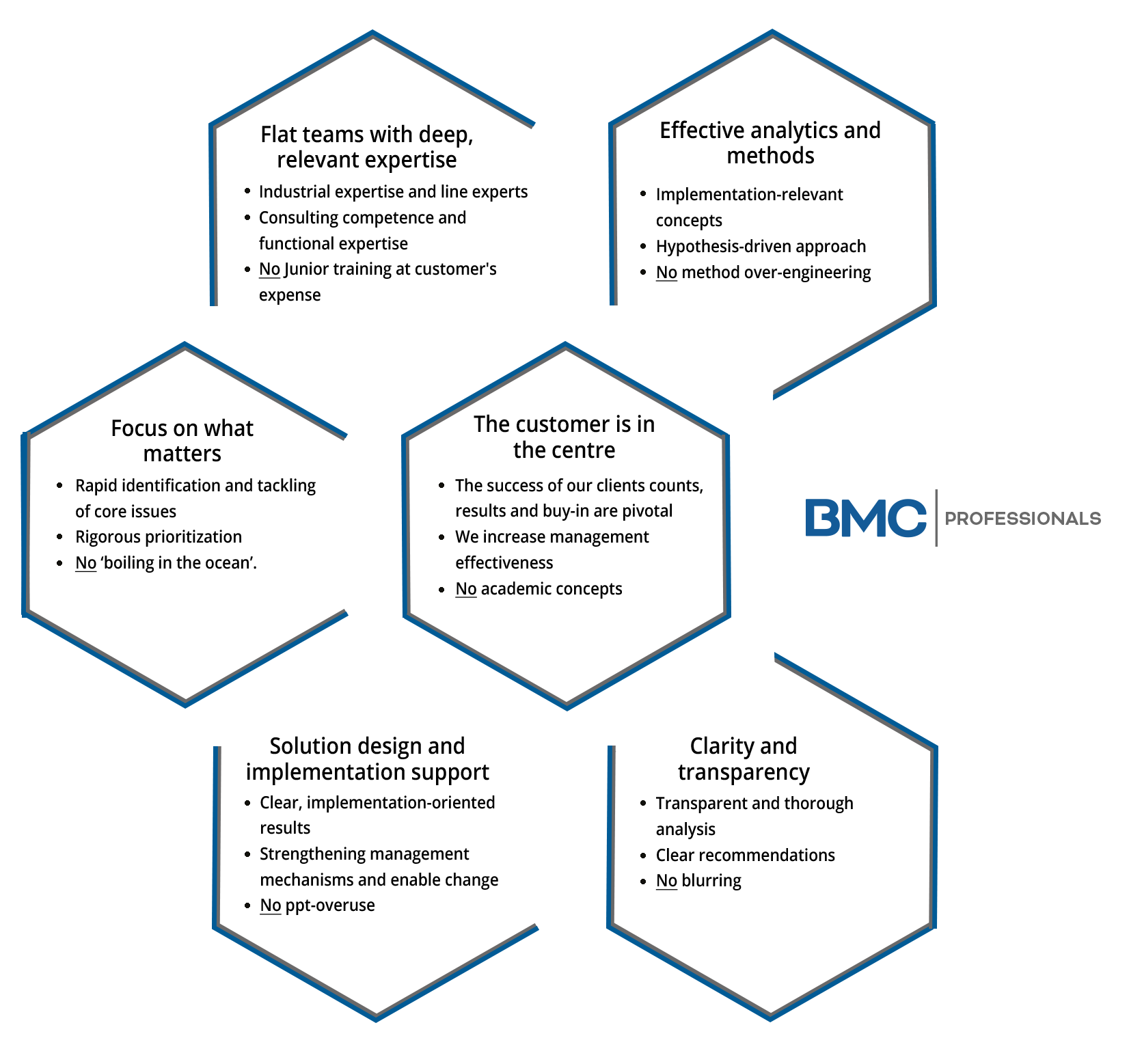

Our Consulting Approach - Customer-centric, Experience-based, Relevant and Effective

Our Consulting Approach - Customer-centric, Experience-based, Relevant and Effective

Project Examples - Results for Our Customers

Project Examples - Results for Our Customers

Retail Strategy for a Bank

Customer challenge: "Is classic retail banking coming to an end? What does sustainable retail banking look like?"

Low interest rates, increasing competition from "digital" providers, unfavorable cost structures and additional regulatory costs are weakening the strategic positioning of many retail banks. With the support of BMC Professionals, our client has refined its sustainable strategy and initiated an implementation program.

Project approach and result: "Customer-centric, focused business model"

Together with our client, we have conducted a strategy development process: markets and market potential were examined first, following which customer and product structures were financially evaluated. In addition, customer requirements for the bank were gathered directly in "customer focus groups". Competition was examined with regard to both digitization strategies and financial and sales figures. Together, we have prioritized market opportunities - also against the background of the bank's internal capabilities - and embedded them in a retail business strategy. With our support, the client has defined a set of measures that deliver attractive returns on investments. In total, a 20% improvement in earnings has been achieved.

IT Strategy for a Banking Group

Customer challenge: "What role should IT play in our company, what should it focus on, how much should it cost and how will it be organized?

These core issues were dealt with by a bank's Board of Managing Directors and IT management team. The existing IT strategy was more formal, and gave only partially viable answers to important requirements of the corporate strategy, the specialist area of the regulator, and technological change.

Project approach and result: "Business-oriented, future-proof and compliant".

Our approach to IT strategy definition systematically takes into account market, technological and regulatory factors. Increased requirements for the regulator are set through the BAIT framework, which defines highly operational and specific targets for the banks’ IT strategy, stressing the ever-greater importance of information security and compliance. Technologically, cloud approaches and artificial intelligence are dramatically changing the delivery model and scope of IT services. For the customer, alignment with business functions was essential, while the business functions’ strategic IT priorities had first to be discussed and jointly defined. As a result, a clear, much more ‘business-oriented’ IT strategy was developed, with a clear focus on the bank's success factors (e.g. customer experience, process optimization, efficiency, compliance). A customer-oriented and bimodal (integrating agile components) operating model and a sustainable HR concept for IT have ensured the future viability of the bank and IT.

Agilisation Bank

Customer challenge: "How can we become faster and more flexible in our decisions, while at the same time following clear, transparent and value-adding goals?

The board of a bank recognized the need to break out of rigid and rather formal targeting processes and look for a more agile and relevant management instrument.

Project approach and result: "Clear, flexible, transparent: Objectives & Key Results (OKR)"

This target setting methodology, which originated in the BigTech or FinTech area, transfers agile management principles to complete companies or parts of companies. We have adapted this approach to the specific needs of our customers. The elements to this approach are quarterly goal definition, the operationalization of goals into tangible and measurable "results", and the flexible and reasoned adjustment of goals which market or company require. In particular, the transparent discussion of setting and achieving business unit objectives has significantly improved the level of understanding and cooperation across organizational units. Decisions are made more quickly, and are now value-oriented and transparent. Responsibility is more decentralized, and at the same time more measurable.

Provider Strategy Insurance

Customer challenge: "Our processes are too manual, many documents are paper-based and our IT platform is outdated. How can we overcome this situation, and which strategic partners we should work with?"

An insurance company needed an opportunity/risk assessment of their existing (partner) structures and a reorientation of their IT provider strategy.

Project approach and result: "New strategic partnership for the future of the insurance business."

Based an intensive business-oriented, technical, economic and strategic evaluation, the previous provider’s model was dissolved and the upcoming "forced migration" to a new solution of the old provider was averted. Instead, a new strategic partner was found to best fit the needs of our customer, the existing platform was updated from a technical and capability perspective. Customers, business units and IT are already benefiting from this new provider strategy – the insurance performs "better, cheaper and faster".

Retail Strategy for a Bank

Customer challenge: "Is classic retail banking coming to an end? What does sustainable retail banking look like?"

Low interest rates, increasing competition from "digital" providers, unfavorable cost structures and additional regulatory costs are weakening the strategic positioning of many retail banks. With the support of BMC Professionals, our client has refined its sustainable strategy and initiated an implementation program.

Projektansatz und Ergebnis: „Kundenzentriertes, fokussiertes Geschäftsmodell.“

Together with our client, we have conducted a strategy development process: markets and market potential were examined first, following which customer and product structures were financially evaluated. In addition, customer requirements for the bank were gathered directly in "customer focus groups". Competition was examined with regard to both digitization strategies and financial and sales figures. Together, we have prioritized market opportunities - also against the background of the bank's internal capabilities - and embedded them in a retail business strategy. With our support, the client has defined a set of measures that deliver attractive returns on investments. In total, a 20% improvement in earnings has been achieved.

IT Strategie Bankengruppe

Customer challenge: "What role should IT play in our company, what should it focus on, how much should it cost and how will it be organized?

Diese Kernfragen beschäftigten Vorstand und IT-Führungsteam einer Bank. Die vorhandene IT Strategie war eher formal ausgerichtet und gab auf wichtige Anforderungen der Unternehmensstrategie, des Fachbereichs des Regulators und des technologischen Wandels nur teilweise tragfähige Antworten.

Project approach and result: "Business-oriented, future-proof and compliant".

Unser Ansatz der IT-Strategiedefinition berücksichtigt systematisch die Umfeldfaktoren Markt, Technologie und Regulatorik. Wichtig sind die gestiegenen Anforderungen des Regulators im Sinne der BAIT, die sehr operative und klare Ziele im Rahmen einer IT Strategie einfordert und die den Themen Informationssicherheit und Compliance immer stärkere Bedeutung zumisst. Technologisch verändern Cloud-Ansätze und Artificial Intelligence Liefermodell und Leistungsumfang der IT dramatisch. Kunden-intern war das Alignment mit dem Fachbereich essentiell, wobei die strategischen IT Prioritäten auf der Fachseite zunächst gemeinsam diskutiert und definiert werden mussten. Im Ergebnis wurde eine klare, weitaus stärker als bisher „geschäftsorientierte“ IT Strategie entwickelt, die einen klaren Fokus auf die Erfolgsfaktoren der Bank (z.B. Kundenerlebnis, Prozessoptimierung, Effizienz, Compliance) hat. Ein kundenorientiertes und bimodales (also auch agile Komponenten integrierendes) Operating-Modell sowie ein nachhaltiges IT Personalkonzept sichern die Zukunftsfähigkeit von Bank und IT ab.

Agilisation Bank

Customer challenge: "How can we become faster and more flexible in our decisions, while at the same time following clear, transparent and value-adding goals?

The board of a bank recognized the need to break out of rigid and rather formal targeting processes and look for a more agile and relevant management instrument.

Projektansatz und Ergebnis: „Klar, flexibel, transparent: Objectives & Key Results (OKR).“

This target setting methodology, which originated in the BigTech or FinTech area, transfers agile management principles to complete companies or parts of companies. We have adapted this approach to the specific needs of our customers. The elements to this approach are quarterly goal definition, the operationalization of goals into tangible and measurable "results", and the flexible and reasoned adjustment of goals which market or company require. In particular, the transparent discussion of setting and achieving business unit objectives has significantly improved the level of understanding and cooperation across organizational units. Decisions are made more quickly, and are now value-oriented and transparent. Responsibility is more decentralized, and at the same time more measurable.

Provider Strategy Insurance

Customer challenge: "Our processes are too manual, many documents are paper-based and our IT platform is outdated. How can we overcome this situation, and which strategic partners we should work with?"

An insurance company needed an opportunity/risk assessment of their existing (partner) structures and a reorientation of their IT provider strategy.

Project approach and result: "New strategic partnership for the future of the insurance business."

Based an intensive business-oriented, technical, economic and strategic evaluation, the previous provider’s model was dissolved and the upcoming "forced migration" to a new solution of the old provider was averted. Instead, a new strategic partner was found to best fit the needs of our customer, the existing platform was updated from a technical and capability perspective. Customers, business units and IT are already benefiting from this new provider strategy – the insurance performs "better, cheaper and faster".

We are pleased to announce that we are now BMC Strategy, you can find us now here.

https://bmc-strategy.com/